Meet Adfin, a new UK-based fintech startup aiming to help companies get their invoices paid — whatever it takes. Founded by two fintech experts, the company is starting with a problem and building a product around it. The problem is that it’s still hard to get paid if you’re set up as a sole trader or even a small company that doesn’t have a person dedicated to administrative tasks.

The process of getting paid for work for small businesses and sole traders like lawyers, accountants, consultants, tradespeople and so on typically entails sending the customer an invoice with your bank information. But you also have to track incoming payments and reconcile them to make sure you’ve received the money. Add to that, the experience isn’t that great for your customers.

For returning customers, you can try and set up a direct debit. But it may be hard for these sorts of businesses to convince their customers to let them withdraw money directly from their bank account. As for card payments, it often leads to high processing fees.

“The average consumer only makes 21 e-commerce purchases a year,” Adfin co-founder and CEO Tom Pope said. He previously worked for Tink, the open banking startup that was acquired by Visa. “All the buzz has been around e-commerce, but for your average legal practice or accountancy firm, their payments are stuck in the 90s — bank transfers, card payments taken over the phone, paying really high fees.”

Adfin argues sole traders and small businesses don’t necessarily want to think about the most appropriate payment method. Instead, they just want to get paid and move on. At its core, the startup is building an invoice management platform and a payment platform to simplify critical admin and make getting paid less of a headache.

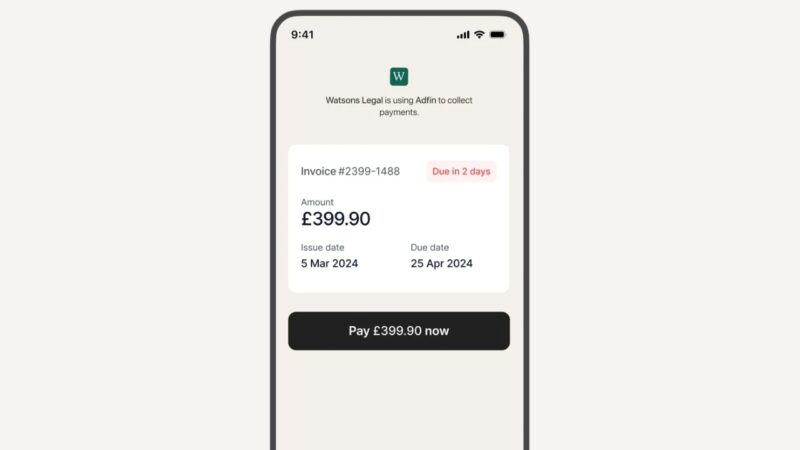

After uploading invoices to Adfin, its customers can use the platform to send payment requests via email, WhatsApp, or SMS.

Adfin then automatically decides the payment method to display depending on various factors, such as whether it’s a returning customer, a small invoice, etc. The company supports pay-by-bank using open banking, card payments including Apple Pay and Google Pay. If the customer doesn’t pay right away, Adfin automates sending reminders too.

“Our customers are not payment nerds. They don’t have to be payments nerds. And I think the fact that they are not payments nerds has probably led to them being a little bit taken advantage of, if I’m honest,” Pope said.

“With Adfin, we just offer you payments. We get you paid and we will handle the payment mix. And obviously, it’s in our interest to be trying to get your success rate as high as possible and your costs as low as possible,” he added.

As Adfin acts as a central repository for all your invoices, companies can check all pending invoices and see if they’ve been paid or not. Adfin currently charges 1% per payment. It doesn’t matter which payment method was used, it’s always going to be 1%.

“As a merchant, everybody wants to get paid as fast as possible, as cheap as possible and with less efforts from your side,” Adfin co-founder and CTO Ciprian Diaconasu (pictured right) said. He previously spent 12 years working for Mambu, a cloud-based banking platform. “So it’s a bunch of capabilities that we’re building that just maximize the timing when you get paid and minimizes the cost of that.”

The startup has already raised $4.9 million in seed funds, co-led by Index Ventures and Visionaries Club. Several business angels also participated in the round, including Thijn Lamers (Adyen founding team); Guillaume Pousaz (Checkout.com founder); Eugene Danilkis (Mambu co-founder); Ferdinand Meyer (Moss co-founder); David de Picciotto (Pledge co-founder); Maximilian Eber and Maik Wehmeyer (Taktile co-founders); and Josef Bovet (Tiller co-founder).