Managing personal finances can be challenging, but the right apps can simplify the process.

If you’re looking for apps like Slice for expense tracking, there are many effective options available.

These apps offer features tailored to various budgeting needs, from zero-based budgeting to envelope budgeting.

Goodbudget is ideal for beginners, providing an easy entry into budget management with its envelope budgeting system.

Choosing the right app can help streamline your finances and support your financial goals.

Similarly, for those seeking alternatives to FamPay for teen banking, several user-friendly apps cater specifically to the financial needs of teenagers.

Table of Contents

ToggleTop Alternatives to Slice

![]()

1. Mint: Budget Tracker & Planner

Mint is renowned for its comprehensive budgeting tools.

It links to users’ bank accounts, credit cards, bills, and investments, giving a holistic view of their financial situation.

Users can set budgets, track spending, and even receive alerts for unusual account charges.

The app provides credit score tracking and personalized tips for reducing expenses.

Mint’s intuitive interface makes it easy for users to categorize transactions and manage their money efficiently.

Key Features

- Comprehensive budget tracking

- Bill reminders

- Credit score monitoring

- Customizable alerts

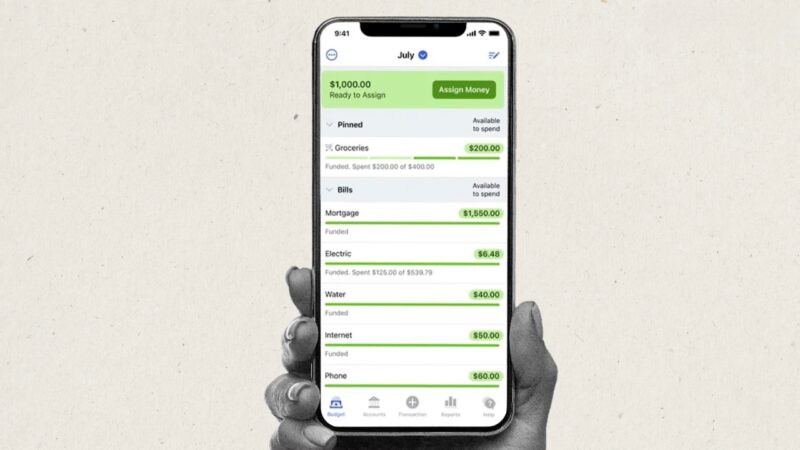

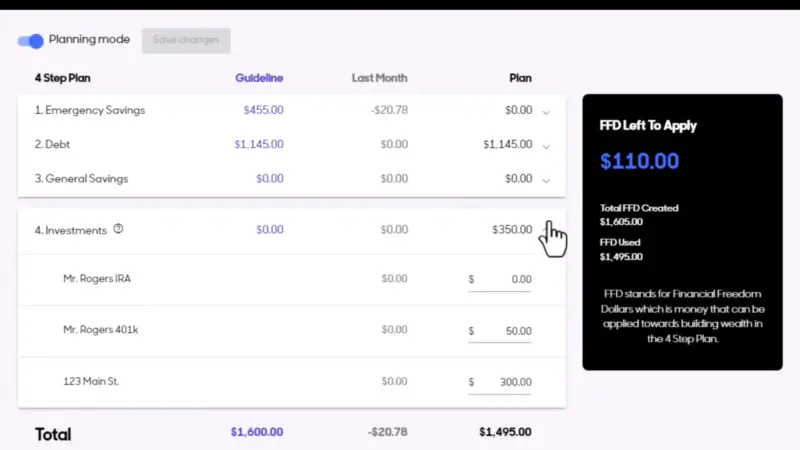

2. You Need A Budget (YNAB)

You Need A Budget, commonly known as YNAB, emphasizes the importance of assigning every dollar a job.

Its principle-based approach to budgeting helps users gain control over their finances, save money, and pay off debt.

The app offers educational resources to assist users in mastering the YNAB method.

It supports the direct import of transactions from bank accounts and provides detailed spending reports, helping users identify spending patterns and make informed financial decisions.

Key Features

- Goal setting and tracking

- Comprehensive education resources

- Detailed spending reports

- Direct transaction import

3. PocketGuard

PocketGuard helps users keep track of their spending by showing exactly how much money is available after accounting for bills, goals, and necessities.

This is one of the apps similar to Slice that connects to users’ bank accounts and categorizes expenses automatically.

PocketGuard helps users identify areas where they can cut back on spending, which can significantly improve financial management. It also features an “In My Pocket” feature, making budgeting straightforward and less stressful.

Key Features

- Automated expense categorization

- Insights to reduce spending

- Bill tracking

- “In My Pocket” feature for easy budgeting

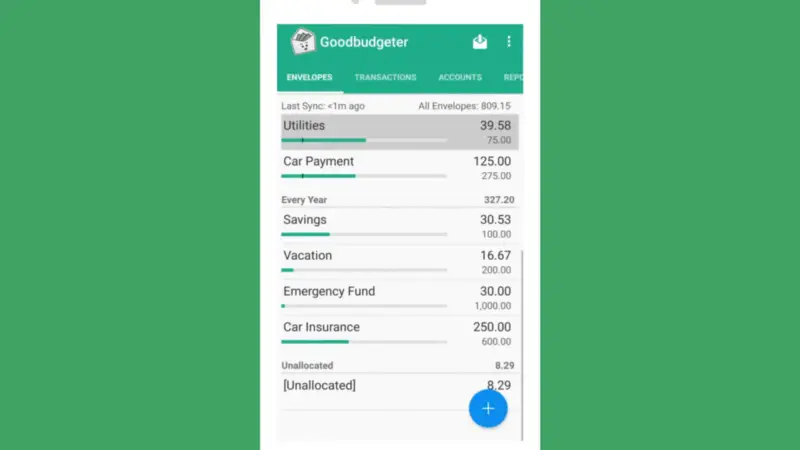

4. GoodBudget

GoodBudget is based on the envelope budgeting method, where users allocate cash for different spending categories.

This approach helps users stick to their budget by ensuring they do not overspend in any category.

It allows users to sync budgets across devices, making it easy for families to manage finances together.

Goodbudget’s simple interface and clear allocation of funds make it an excellent choice for those new to budgeting.

Key Features

- Envelope budgeting system

- Sync across multiple devices

- Family sharing

- Clear fund allocation

5. UniPAY

UniPAY, similar to Slice, allows customers to divide their bills into three equal payments and pay over the following three months without additional fees.

Additionally, UniPAY offers EMI options for 6, 9, 12, and 18 months.

Key Features

- 1% cashback if the total sum is paid in 30 days.

- Lock your card with one click in emergencies.

- 24/7 customer service and support.

- No processing charges.

6. OneCard

OneCard is an alternative to Slice that offers fast payment options and divides the total amount into monthly EMIs for user convenience.

Partnering with major banks such as IDFC First Bank, South Indian Bank, SBM Bank, and Bank of Baroda Financial, OneCard provides a premium metallic credit card.

Users can quickly sign up and start using the card’s features immediately.

OneCard also offers up to 5x rewards on the top two spending categories, and its user-friendly interface helps users track their spending with timely information.

Key Features

- Activate your new account in less than 5 minutes.

- Easily split your payments into EMIs.

- Receive a premium metallic credit card.

- Manage your EMIs independently using the EMI dashboard.

- Enjoy fast rewards and exclusive deals

7. PostPe

BharatPe’s PostPe is a buy-now-pay-later app that allows users to obtain credits and use them at various retailers.

Unlike many other apps similar to Slice, PostPe offers a 30-day interest-free repayment period.

Additionally, it provides consumers with credit of up to Rs. 10 lakh based on their CIBIL score.

With PostPe’s QR code scanning capability, consumers can quickly make payments and convert them into EMIs.

The bill is generated on the first day of each month, and users can choose to divide their payments into EMIs of 3, 4, 5, or 6 months.

Key Features

- Interest-free repayment for 30 days.

- QR code payments with EMI conversion.

- Bill generation on the first day of each month.

- Option to divide payments into 3, 4, 5, or 6 month EMIs.

- Credit up to Rs. 10 lakh based on CIBIL score.

8. vCard

vCard is a loan app similar to Slice, offering a 50-day interest-free credit policy.

Users can immediately utilize their credit to make purchases, pay friends, or transfer it to their accounts.

vCard ensures smooth service and provides 24-hour customer assistance, making it a reliable alternative to Slice.

Additionally, the app allows users to keep track of their credit card expenditures.

Key Features

- Simple setup with paperless KYC.

- Special deals and discounts from retailers.

- Helps raise consumers’ credit scores.

- Users receive timely rebates and perks.

9. Wizi

Wizi offers its members various credit cards from leading banks across the nation.

While many apps are similar to Slice, Wizi stands out with its user-friendly layout, assisting in both processing new credit cards and managing existing ones.

With Wizi, users can easily pay their expenses and divide them into EMIs later.

Key Features

- Swift approval during registration.

- No documentation required for onboarding.

- Absolute transparency.

- Collaborates with major banks, including ICICI Bank and American Express.

- Manage bills, EMIs, and more from a single platform.

10. Aspire

Aspire is a digital credit card app similar to Slice, offering consumers various services and benefits.

As one of India’s first digital credit cards, Aspire allows quick purchases and the option to divide payments into four interest-free installments.

Users can get their credit limit by logging into the app using their mobile number connected to UPI. Aspire does not require a CIBIL score or an existing credit card.

Key Features

- 5-minute registration process.

- Full account management via mobile device.

- One-click transactions with various vendors.

- Zero convenience fees.

- Minimal monthly cost.

Related Posts:

- 12 Best Apps Like Pinterest for Inspiration for 2024

- 11 Best Apps Like Castle TV for Streaming in 2024

- Best Free Streaming Apps Similar to Pikashow - Top 10 Picks

- India’s Top Apps in 2025 - The Digital Tools You…

- Starting Your Own Pet E-Commerce Store - Top 15…

- Top 10 Social Networks That Are Bigger Than You…