It’s not every day that OpenAI founder Sam Altman teaches your class at Stanford. That’s the kind of entrepreneurial spirit Lawrence Lin Murata, co-founder and CEO of Slope, tapped into when he and Alice Deng started their B2B payments company.

“We met back in 2016 when he taught a class called ‘How to Start a Startup,’” Lin Murata said. “He also gave a few talks, and we ended up staying in touch.”

This connection grew stronger over time and turned into a significant vote of confidence when Lin Murata and Deng launched Slope in 2021. After raising a seed round in 2021 and Series A in 2022, Altman supported the company for its $30 million venture round in 2023.

“He was really impressed with the progress we made at Slope,” Lin Murata said.

We are excited to announce our $30 million equity round led by @USV, with major participation from @OpenAI’s @sama, bringing our total equity and debt funding to $187 million.⚡ https://t.co/IggwXgCVQG

— Slope (@slopepay) September 27, 2023

Slope, based in Silicon Valley, is a B2B payments platform offering order-to-cash workflow automation for enterprise companies. Enterprise customers use Slope to manage transactions, optimize payment processes, accept online payments, and provide financing options to their buyers.

Behind Slope’s technology are Lin Murata and Deng’s backgrounds in artificial intelligence. They have built proprietary large-language models (LLMs) that power the company’s underwriting infrastructure, including B2B checkout, customer and vendor risk assessment, payment reconciliation, and cash management. Their models are trained on proprietary banking data and alternative data sources like public information and social media to create accurate financial metrics for underwriting.

Before founding Slope, Lin Murata started Newton Technologies in the self-driving car industry. After its acquisition by Nauto, he brought over early data science and engineering hires to Slope. The company has invested in machine learning, data infrastructure, and real-time customer monitoring to create viable risk profiles.

Lin Murata noted that while self-driving car AI and LLM AI for financial transactions are different, they share the need for speed. “Self-driving is such a cutthroat industry based on how fast you iterate on the models,” he said. “With Slope, iteration speed is a big moat. We have an active learning system to constantly retrain and improve the model as we get new data.”

Aside from the investment, Sam Altman’s influence has been significant for the company. Lin Murata mentioned that the company’s name was inspired by one of Altman’s tweets about hiring for potential rather than current skills.

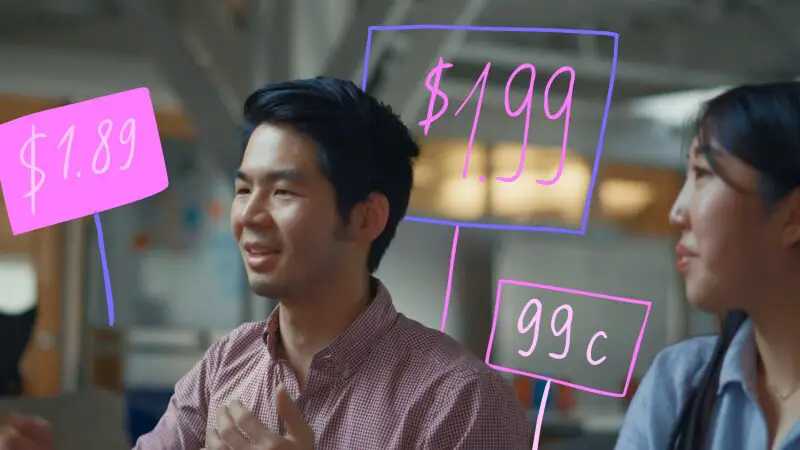

“That’s why we are called Slope,” Lin Murata said. “We believe in the iteration pace. You see in Sam’s career, and also my career, as outsiders of fintech, we’re big believers in high slope. If you have two curves, one that has a higher Y-intercept, the other one starts lower. As long as you have a slope, you’re eventually going to surpass the other one.”

Though Deng declined to share specific customer and revenue figures, she mentioned that Slope works with several Fortune 500 companies, with more to be announced soon.

In addition to Sam Altman, his brothers Jack and Max Altman have also invested in Slope. Jack Altman, founder and former CEO of HR software startup Lattice, brings people management expertise and investment experience from his firm Alt Capital. Max Altman, co-founder and managing partner at Saga Ventures, has helped Slope with company leadership and sales team scaling. Sam Altman assists with strategic planning, market strategy, and board management.

Slope secured JP Morgan Payments as the lead in a new $65 million strategic equity and debt financing round, bringing the total funding to $252 million. The funding will be used to scale the team and operations to serve more large enterprises.

With the B2B payments market expected to grow to $174 trillion by the end of the decade, Slope faces competition from companies like Paystand and global players like Monite, Two, Xepelin, and Nala. However, the support from JP Morgan Payments provides a significant advantage. JP Morgan Payments processes nearly $10 trillion in payments each day and has chosen Slope to provide clients with short-term financing solutions.

James Fraser, global head of trade and working capital at JP Morgan Payments highlighted Slope’s strengths in underwriting and credit risk monitoring. As part of the investment, Fraser will join Slope’s board as a board observer.

When asked if this partnership could lead to an acquisition, both founders firmly said no.

“Our goals are the same, and we’re super clear with them. We want to build a category-defining company,” Lin Murata said.