Your teen is growing up and needs to get a grip on managing money. It’s smart to chat about personal finance and money management over dinner.

But if your teen is glued to their phone or tablet, why not let them learn directly from the apps like FamPay they’re already using?

Gen Z’s attention span is pretty short—about 8 seconds, to be exact.

That’s why money apps designed for teens simplify tricky financial stuff into easy, bite-sized pieces that can catch their attention quickly.

Table of Contents

Toggle1. GoHenry

GoHenry is a popular choice for parents seeking a prepaid debit card specifically designed for children and teens.

Cost Structure

The service charges $4.99 per child per month. They also offer a family plan, which costs $9.98 per month for up to four children.

Features

- Financial Literacy: Kids can earn bonus cash by completing financial literacy lessons.

- Accessibility: No fees at ATMs or for foreign transactions.

- Mobile App: The app boasts high ratings, with 4.5 stars on the Apple App Store and 4.2 stars on Google Play.

User Experience

Parents can easily manage their children’s spending, set tasks, and monitor financial progress. The app provides a straightforward interface that is user-friendly.

Pros

- No ATM fees

- No foreign transaction fees

- High user ratings

- Family plan option

Cons

- Monthly fee applies

- Limited to up to four children for the family plan

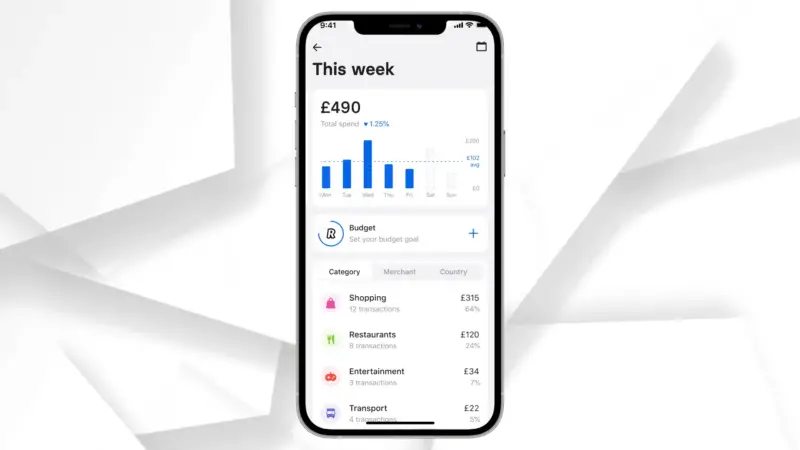

2. Revolut Junior

Revolut Junior offers an engaging way for young people to learn about money management.

Designed specifically for ages 6 to 18, this app aims to instill financial literacy early on.

Parents can easily create a Junior account through their own Revolut account.

The user-friendly interface makes it simple to set budgets, monitor spending, and set up savings goals.

Features at a Glance

- No Monthly Fees

- Prepay Visa or Mastercard

- Parental Control

Pros

- Easy to Use: Simple user interface.

- Integrated with Parent Account: Full control and oversight for parents.

- Financial Learning Quizzes: Engaging, interactive learning.

Cons

- Requires a Parent Account: Parents must have their own Revolut account.

- Limited Features Outside Revolut: Not usable independently of the Revolut ecosystem.

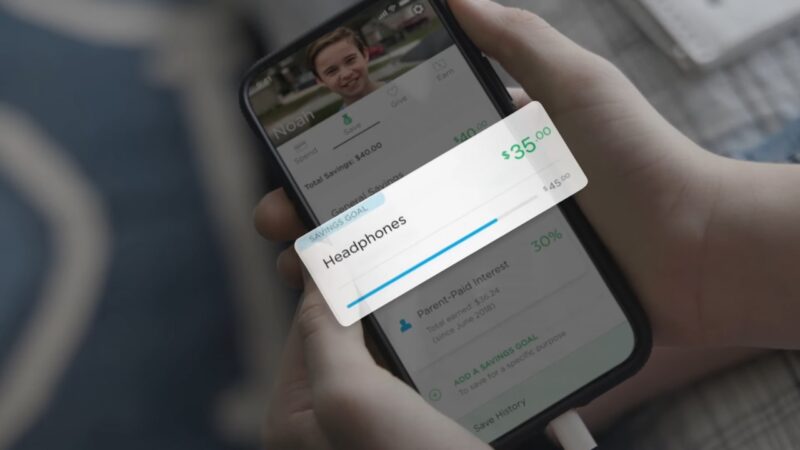

3. Greenlight

Greenlight stands out for its comprehensive parental controls that give parents significant oversight over their children’s spending habits.

With the app, parents can set spending limits for specific categories such as food, entertainment, and shopping.

Features

- Spending Limits

- Real-Time Notifications

- Allowance Distribution

Parents can also approve or deny transactions in real-time. This level of control helps maintain financial discipline and ensures that funds are used wisely.

Another feature is the option to assign chores and link payments to their completion. This helps teach children the value of earning money.

4. Copper Banking

Copper Banking stands out as a practical financial app designed specifically for teens. It features a prepaid debit card along with saving, investing, and earning functionalities.

The prepaid debit card allows users to spend money while sticking to a budget. It can be funded through external banks and payment apps.

Copper emphasizes financial literacy by combining educational resources with its banking services. Teens can learn about money management while using the app’s features.

Key Features

- Prepaid Debit Card: Easier to manage and control spending.

- Educational Resources: Helps teens understand finances.

- Investing Feature: Allows for beginner-level investments.

- FDIC Insurance: Up to $250,000, through Evolve Bank & Trust.

Copper also offers parental controls allowing parents to oversee their kids’ spending and saving habits. This means parents can create accounts for up to five kids.

Fees

There are minimal fees associated with certain activities:

- Cash reloads: Up to $4.95 per load.

- Debit reloads: 2.5% fee, plus $0.30 per transaction.

Pros

- Provides a structured learning environment.

- Financial resources tailored to teens.

- Secure with FDIC insurance.

Cons

- Some fees for cash and debit reloads.

- Low checking account APY of 0.001%.

5. Step

Step offers a no-fee banking solution designed specifically for teenagers. With the Step Visa Card and app, teens can manage their savings, earn interest, and build good financial habits.

Parents and teens alike trust Step for its user-friendly interface and security. The app helps teens earn 5.00% APR on their savings and report positive credit history, which is advantageous for their future financial health.

Key Features

- No Fees

- Parental Controls

- Educational Tools

| Feature | Details |

|---|---|

| APY | 5.00% |

| Minimum Age | 13 years |

| Parental Oversight | Real-time transaction alerts and controls |

| Fees | None |

Step also collaborates with Evolve Bank and Trust to provide FDIC-insured banking services. Founded in 2018 by CJ MacDonald and Alexey Kalinichenko, Step aims to blend financial education with practical banking tools to empower young users.

6. Current

Current is a compelling choice for teens’ banking. It offers a seamless way for young users to manage their finances responsibly and maturely.

Features

- Instant Transfers

- Spending Insights

- Savings Pods

Parental Controls

Parents can set spending limits and track their child’s transactions in real time, fostering responsible financial behavior.

The app offers a user-friendly interface, making it easy for teens to navigate and understand their financial activities. The mobile app is compatible with both iOS and Android devices.

Safety

Current offers various security features such as blocking and unblocking the card through the app. It also sends instant alerts for transactions, ensuring added security.

No Hidden Fees

Current prides itself on transparency, with no hidden fees or overdraft charges, making it an attractive option for both teens and their parents.

Customizable Cards

Teens can personalize their Current debit card, adding a touch of individuality to their banking experience.

7. Chase First Banking

Chase First Banking is designed for parents who want to teach their children about money management. This account is available for kids aged 6-17 and offers a tailored experience to bridge traditional banking and modern needs.

To open a Chase First Banking account, parents must have an existing qualifying Chase checking account. This ensures seamless integration between the child’s account and the parent’s oversight capabilities.

The account includes features such as no monthly service fee and tools to help both parents and kids manage finances. Parents can set spending limits, assign chores, and offer allowances directly through the account.

Kids can use a debit card at stores and ATMs. There is a daily purchase limit of $400 and ATM withdrawal limits to ensure controlled spending.

For children aged 13-17, Chase offers the option to transition to a High School Checking account, which provides more autonomy with similar oversight from parents.

8. Alliant Credit Union Teen Checking

One standout feature of the Alliant Credit Union Teen Checking account is its interest-earning potential.

Unlike many teen checking accounts, this account offers a competitive annual percentage yield (APY) of 0.25%.

This interest rate makes it attractive for parents and teens looking to grow their savings.

The account is fee-free, eliminating monthly maintenance fees.

Additionally, it provides up to $20 per month in out-of-network ATM fee reimbursements, further enhancing its value.

There are a few simple requirements to meet to earn interest.

These include having eStatements and at least one electronic deposit made to the account each month.

These criteria are easy to fulfill, ensuring the interest is accessible to most account holders.

Linking parents to the account as joint owners allows them to oversee their teen’s financial activities.

This transparency helps monitor and foster responsible banking habits.

Teens benefit from a full-featured debit card, which is handy for purchases and ATM withdrawals.

The combination of fee-free banking and an attractive APY makes the Alliant Credit Union Teen Checking account a noteworthy choice for teens starting their financial journey.

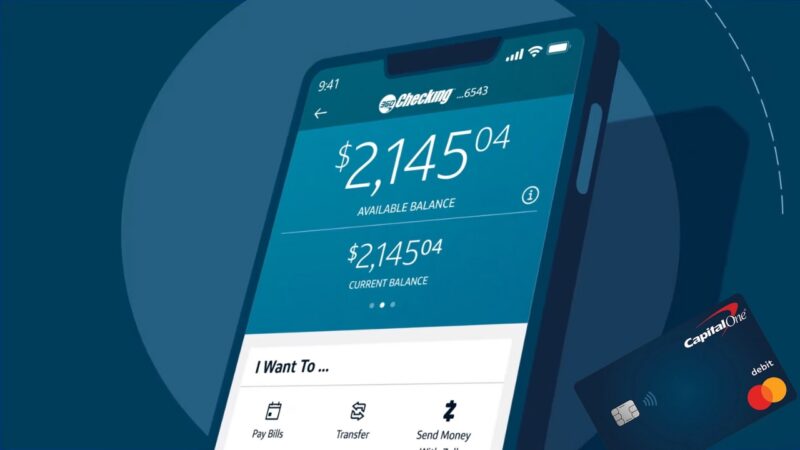

9. Capital One MONEY

Capital One MONEY offers a comprehensive solution for teen banking, designed specifically for individuals under 18.

This account includes a debit card and allows both parents and teens to manage the finances together.

Features

- Age Range: This account is available for teens aged 8 and older, with a joint account holder who is a parent or legal guardian.

- No Fees: The account comes with no monthly fees or minimum balance requirements.

- Interest: Teens can earn a small amount of interest on their balance.

Parental Controls

- Real-time alerts for transactions

- Spending limits to encourage budgeting

- Remote lock feature for the debit card in case of loss

Accessibility

With access to over 70,000 ATMs, teens find it convenient to withdraw cash when needed.

- Mobile app integration provides easy tracking of spending and balances.

- Deposit Options: Though depositing cash can be more challenging, digital transfers are simple and quick.

Transition to Adulthood

Once they turn 18, teens can easily transition their account to a 360-checking account if they choose. If not, their MONEY account remains open for continued use.

Related Posts:

- Synapse Bankruptcy Loses 160m - Ripple Effects on…

- 11 Best Omegle Alternatives for Safe and Fun…

- 4 Best FMovies Alternatives for Free Movie Streaming in 2024

- The Best CouchTuner Clones and Alternatives for Free…

- 26 Best 123Movies Alternatives for Free Movie…

- Top 7 Best SMG in COD Mobile 2025 – Best Picks for Ranked