Bijnis, a B2B marketplace targeting the unorganized retail sector, experienced a doubling of its growth during the previous fiscal year, which ended in March 2023.

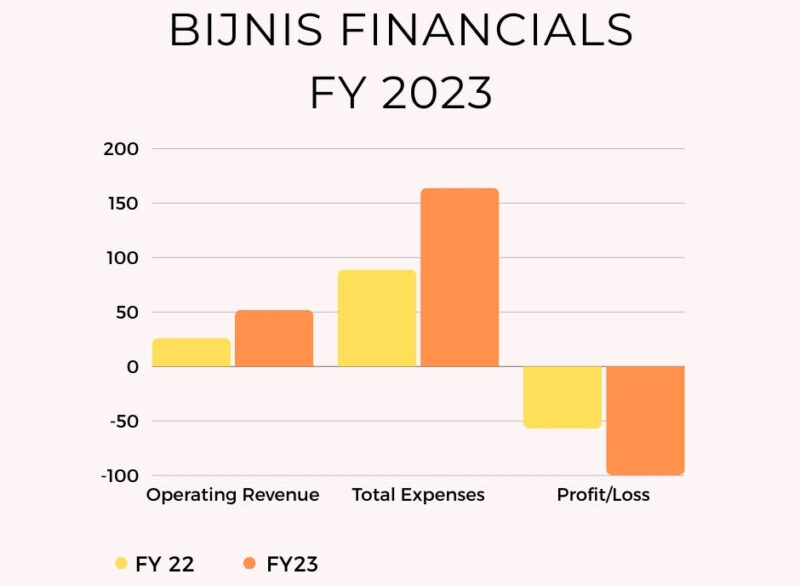

However, along with this impressive growth, the Delhi-based startup also faced a substantial increase in losses, approaching the Rs 100 crore mark. This represents a rise of 75% compared to the previous year.

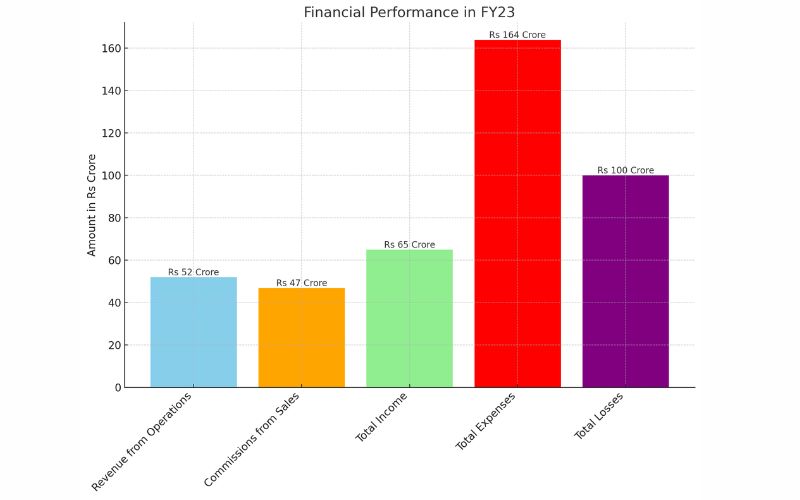

In its latest financial statements to the Registrar of Companies, Bijnis reported its revenue from operations jumped to Rs 52 crore in FY23, up from Rs 26 crore in FY22. The platform serves as a vital link between manufacturers, suppliers, traders, and retailers, helping them to scale their operations.

The majority of Bijnis’s operating revenue, accounting for about 90%, is generated from commissions on sales made through its platform. In FY23, these commissions more than doubled, reaching Rs 47 crore. The startup also derives revenue from other sources such as freight services and the sale of goods.

Investments also played a significant role in boosting Bijnis’s financial position, with Rs 13 crore earned from interest and investment gains. This contributed to a total income of Rs 65 crore for the year.

However, similar to many tech startups, Bijnis faces considerable expenses, with employee benefits consuming half of its total expenditure. These costs experienced a surge of over 82%, amounting to Rs 82 crore in FY23. Additionally, the freight costs increased by 60%, reflecting the company’s expansion efforts.

In FY23, Bijnis witnessed a significant surge in overall expenses, which soared by 84.3% to Rs 164 crore.

The increase was driven by higher costs in areas such as procurement, advertising, travel, IT, legal fees, and other overheads. The substantial rise in spending, particularly in employee benefits, freight, and marketing, contributed to a steep 74.6% increase in losses. The total losses for FY23 amounted to Rs 100 crore.

Despite these financial challenges, Bijnis has attracted significant investment, raising around $42 million to date. This includes a substantial $30 million funding round led by Westbridge Capital in September 2021. TheKredible Info Edge stands out as the largest external shareholder, owning a 26.3% stake, with Matrix Partners and Peak XV Partners each holding 14.21%.

Bijnis’s focus on the footwear segment has positioned it uniquely in the B2B marketplace. Looking to emulate the success of companies like Zetwerk, Bijnis is exploring opportunities to serve smaller manufacturing firms, a move that will require sustained support from its investors in the coming months as it seeks to gain traction in this broader market.

Source: https://entrackr.com/2024/04/bijnis-records-100-growth-in-fy23-losses-touch-rs-100-cr/