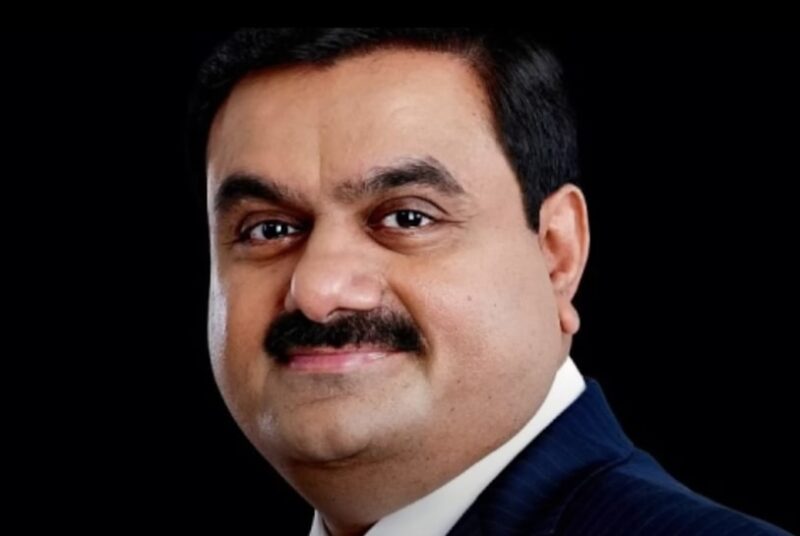

The spotlight on Gautam Adani in 2024 continues as he rebounds from past financial challenges. Gautam Adani Net Worth is again a point of focus as his strategic choices have led to significant growth. Backed by sectors like energy and infrastructure, his financial recovery shows the strength of his approach and position among the world’s richest.

| Full Name | Gautam Shantilal Adani |

| Nationality | Indian |

| Date of Birth | June 24, 1962 |

| Profession | Businessman, Chairman of Adani Group |

| Net Worth (2024) | $85 billion – $97 billion |

| Primary Industries | Energy, Infrastructure, Ports, Logistics |

| Spouse | Priti Adani |

| Children | Karan Adani, Jeet Adani |

| Key Achievements | Founder of Adani Group, Major Contributor in Indian Infrastructure |

Table of Contents

ToggleWhat is Gautam Adani Net Worth?

After facing substantial challenges in 2023 due to allegations and a market crash, his wealth has surged, placing him back among the top billionaires worldwide.

Current Net Worth Range

As of 2024, Gautam Adani Net Worth is estimated between $85 billion and $97 billion. His wealth primarily comes from his diversified business interests through the Adani Group, which includes sectors such as energy, infrastructure, ports, and logistics. The exact figure may vary depending on market fluctuations and performance of his companies.

Factors Contributing to Gautam Adani Net Worth in 2024

- Strong Performance of Adani Group Stocks

The resurgence of Adani Group stocks, particularly in sectors like energy, renewable resources, and infrastructure, has played a crucial role in boosting Gautam Adani Net Worth. Stocks such as Adani Enterprises, Adani Green Energy, and Adani Ports have seen consistent growth, driving his financial recovery. - Strategic Investments and Global Expansion

Adani’s investments in both domestic and international projects have been key contributors. From renewable energy projects in India to port operations in Australia, his global reach continues to expand. These ventures have secured steady revenue streams, further enhancing his wealth. - Debt Management and Financial Maneuvering

Early debt repayments and strategic stake sales in key ventures have restored investor confidence, leading to a rebound in the group’s market value. The successful refinancing of major loans and securing of new investment deals have also stabilized his financial standing.

Key Business Ventures Driving Gautam Adani Net Worth

The rapid growth in Gautam Adani Net Worth is heavily influenced by the strategic expansion and performance of his key business ventures. These companies form the backbone of the Adani Group, with significant operations in sectors like energy, infrastructure, logistics, and more.

Core Businesses Contributing to Gautam Adani Net Worth

1. Adani Enterprises Limited (AEL)

Adani Enterprises is the flagship company of the Adani Group and plays a pivotal role in driving Gautam Adani Net Worth. AEL is involved in diverse businesses, including coal trading, mining, renewable energy, airport management, and more. Its consistent growth and diversification have been crucial in elevating the group’s overall financial performance.

2. Adani Ports and Special Economic Zone (APSEZ)

APSEZ is India’s largest private multi-port operator, responsible for handling nearly 25% of the country’s cargo. Its dominance in the logistics and port sectors has significantly contributed to Gautam Adani Net Worth, with expansions and new port acquisitions adding to the group’s valuation.

3. Adani Green Energy Limited (AGEL)

AGEL has positioned itself as one of the largest renewable energy companies in India. It focuses on solar and wind energy projects, aligning with global trends toward sustainable energy. The rapid growth of AGEL has played a vital role in the increase of Gautam Adani Net Worth, as renewable energy investments are seen as key growth drivers for the group’s future.

4. Adani Transmission Limited

Adani Transmission operates extensive transmission lines across India, ensuring stable electricity distribution. The consistent expansion in this sector continues to fuel Gautam Adani Net Worth, particularly as demand for energy infrastructure grows.

5. Adani Power Limited

Adani Power operates thermal power plants and is exploring new avenues in renewable energy. It remains a significant contributor to the group’s overall revenue, helping maintain the upward trajectory of Gautam Adani Net Worth.

Expansion into Airports and New Ventures

The acquisition and management of airports across India have been major growth factors for Adani Group. Running airports in key cities like Mumbai, Lucknow, and Ahmedabad has diversified revenue streams and bolstered Gautam Adani Net Worth. Additionally, his ventures into sectors like data centers and defense are set to further strengthen his business empire.

Significant Financial Moves and Investments in 2024

Gautam Adani Net Worth in 2024 reflects the strategic financial moves and major investments that have driven his empire’s expansion. These moves include key acquisitions, global partnerships, and significant investments that have directly impacted his wealth growth.

Major Partnerships and Acquisitions Boosting Gautam Adani Net Worth

1. Investment from GQG Partners and Qatar Investment Authority

In 2024, Gautam Adani secured significant investments from GQG Partners and Qatar Investment Authority. These entities invested heavily in various Adani Group companies, providing much-needed capital that bolstered confidence in the group’s financial stability. This inflow of capital has played a crucial role in stabilizing and boosting Gautam Adani Net Worth after the setbacks from 2023.

2. Acquisition of Ambuja Cements and ACC

A significant boost to Gautam Adani Net Worth came from the strategic acquisition of Ambuja Cements and ACC, two of India’s largest cement companies. The deal, valued at over $10 billion, solidified Adani Group’s presence in the construction and building materials sector. This acquisition has strengthened the group’s market share and added substantial value to its portfolio.

3. Expansion of Renewable Energy Projects

Adani’s aggressive push into renewable energy, particularly through Adani Green Energy, continues to be a major growth driver. In 2024, the group expanded its solar and wind energy projects, particularly in Rajasthan and Gujarat. These projects have attracted global attention and secured international funding, further increasing Gautam Adani Net Worth.

4. Strategic Debt Refinancing and Capital Management

In 2024, Adani Group successfully refinanced $3.5 billion in loans, which stabilized the financial position of the group’s key companies. This move also involved the sale of minority stakes in some ventures, allowing the group to manage its debt more effectively while maintaining overall control. This restructuring has provided a stable foundation for growth and has had a direct positive impact on Gautam Adani Net Worth.

Key Sectors Fueling Gautam Adani’s Financial Growth

The growth of Gautam Adani’s wealth in 2024 is primarily driven by his involvement in several high-impact sectors. His diversified business portfolio covers major areas like energy, infrastructure, and logistics, all of which contribute significantly to his financial dominance.

Energy and Power Sector

- Thermal and Renewable Energy

Adani’s ventures cover both traditional thermal power generation and renewable energy. Adani Power is a major player in India’s private energy sector, contributing significantly to his financial success. Simultaneously, Adani Green Energy has rapidly grown, securing large-scale solar and wind projects across India, making it a key factor in his wealth growth. - Green Hydrogen Initiatives

Adani’s push into green hydrogen through Adani New Industries Limited (ANIL) is designed to capture the global shift toward clean energy. The group is investing heavily in this emerging sector, positioning itself as a future leader in green hydrogen production.

Infrastructure and Ports

- Adani Ports and Special Economic Zone (APSEZ)

APSEZ is India’s largest private multi-port operator, handling around 25% of the country’s cargo. The group’s ongoing projects, expansions, and port acquisitions are essential to maintaining Adani’s financial strength. Its consistent growth directly supports his wealth increase. - Airport Management and Operations

Adani’s entry into the airport management sector has opened new revenue channels. His group now operates key airports across India, including in Mumbai and Ahmedabad, which has diversified his income and strengthened his market presence.

Logistics and Transportation

- Adani Logistics Limited

Adani Logistics plays a crucial role in end-to-end supply chain management. The expansion of its warehousing and transportation services across India continues to drive steady income and adds value to Adani’s overall financial portfolio.

Recovery from 2023 Setbacks

In 2023, Gautam Adani’s businesses took a huge hit after serious allegations caused a sharp drop in his wealth. But 2024 has been a comeback year, where smart moves helped him bounce back stronger than before.

How He Handled the Hindenburg Report Blow

The Hindenburg report hit like a truck, causing massive damage to his empire. Stocks plummeted, investors panicked, and his net worth took a nosedive. But instead of just sitting back, Adani’s team hit back with a detailed defense. This helped calm things down and slowly bring investors back on board.

Smart Financial Moves and Debt Handling

Early repayment of debts was one of the key steps in getting his financial stability back. On top of that, Adani sold off stakes in some areas while keeping the core parts of his empire intact. These moves not only brought in fresh cash but also showed that he’s still in control and knows how to handle pressure.

Global Influence and Expansion of the Adani Group

Gautam Adani’s business influence isn’t just limited to India; he’s taken major steps to expand globally. His push into international markets, strategic partnerships, and large-scale projects outside India are key reasons why his net worth has seen a strong rise in 2024.

Expanding into New Markets

Adani’s group has made big moves in Australia, including taking control of the Abbott Point Port and launching the Carmichael coal mine. These projects weren’t without controversy, but they’ve given Adani a foothold in the global market, boosting his overall financial power.

Renewable Energy on a Global Scale

Adani’s focus on renewable energy isn’t just limited to India. His group has been involved in solar and wind projects in various countries, setting up massive installations that contribute to global green energy initiatives. This global presence helps secure more deals and brings in revenue from international sources, adding another layer to his empire.

Market Impact and Future Projections

Gautam Adani’s market presence has only grown stronger in 2024, with his strategic decisions positioning him for continued success. Analysts are closely watching how his next moves could impact his net worth even further.

Stock Market Performance

Adani Group stocks have rebounded impressively this year after the dip in 2023. Companies like Adani Enterprises, Adani Ports, and Adani Green Energy have seen strong gains, driving up Gautam Adani Net Worth. Investor confidence is back, thanks to smart financial restructuring and capital management.

Upcoming Projects and Expansion Plans

Adani isn’t slowing down. Plans are in place for new projects in green hydrogen, solar energy, and global logistics. These future ventures are expected to bring in substantial revenue, adding to his already massive wealth. His focus on sustainable energy aligns with global trends, giving him an edge in securing future deals and partnerships.

Risks and Challenges Ahead

While the outlook is mostly positive, potential risks include market volatility, regulatory hurdles, and geopolitical issues. However, if the past is any indication, Adani’s strategic approach should help him navigate these challenges effectively.

FAQs

How Did Gautam Adani Start His Business?

Gautam Adani started his business journey in 1988 by founding Adani Enterprises, which initially focused on commodity trading. Over the years, his vision expanded the company into a global conglomerate that operates in sectors like energy, infrastructure, and logistics. His entry into major industries was driven by identifying opportunities in underdeveloped sectors of the Indian market.

What Companies Are Under the Adani Group?

The Adani Group consists of several major companies, including Adani Enterprises, Adani Ports and Special Economic Zone, Adani Power, Adani Green Energy, Adani Transmission, and Adani Total Gas. Each of these companies operates in distinct sectors such as energy, infrastructure, logistics, and gas distribution.

How Many Airports Does Adani Operate?

Adani Group manages and operates seven airports across India, including key locations like Mumbai, Ahmedabad, and Lucknow. These airport operations are part of his broader strategy to expand into infrastructure management and transportation.

What Role Does Renewable Energy Play in Gautam Adani’s Wealth?

Renewable energy has become a crucial part of Gautam Adani’s portfolio, particularly through Adani Green Energy. The company’s rapid expansion into solar and wind energy projects has positioned it as a key player in India’s renewable energy sector, contributing significantly to his overall net worth.

How Did the Hindenburg Report Affect Gautam Adani Net Worth?

The Hindenburg report in 2023 caused a sharp decline in Gautam Adani’s net worth, wiping out billions in a short time. The allegations of stock manipulation and improper use of offshore accounts led to a significant drop in investor confidence and Adani Group’s stock prices. However, strategic recovery efforts in 2024 helped regain much of the lost value.

Last Words

Gautam Adani made a big comeback in 2024. After tough times, his strategic moves, expanding businesses, and global growth helped push his wealth back up. His efforts in energy, logistics, and infrastructure played key roles in rebuilding his fortune. With more plans ahead, his financial strength keeps growing.