Hebbia, a startup that uses generative AI to search large documents and respond to complex questions, has raised a $130 million Series B at a roughly $700 million valuation led by Andreessen Horowitz, with participation from Index Ventures, Google Ventures, and Peter Thiel.

This funding highlights that a 50x annual recurring revenue (ARR) multiple is becoming the norm for AI startups, especially those that have booked millions in profitable revenue early on. Despite continuing to raise another $30 million after the initial report, Hebbia has not yet filed an updated disclosure on this funding round to the SEC; the latest filing still indicates raising around $100 million of new equity.

Hebbia, founded by George Sivulka while pursuing a PhD in electrical engineering at Stanford, had an ARR of $13 million and was profitable when pitching investors, according to a knowledgeable source. Sivulka, the startup’s sole founder and CEO, noted that the company’s revenue grew by 15x over the last 18 months.

The $700 million valuation suggests investors valued Hebbia at about 54 times ARR. Such valuations were common during the pandemic boom and are now routinely assigned to prominent AI startups. Hebbia’s closest analogues, Glean and Harvey, had valuations slightly over 60x ARR.

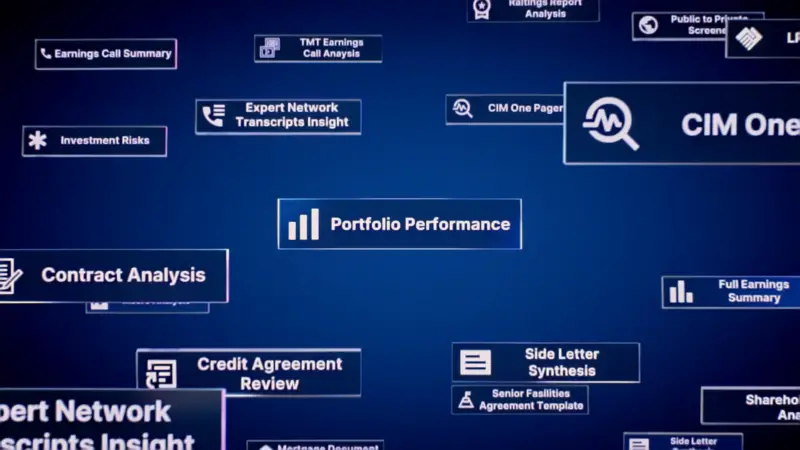

Founded in 2020, Hebbia initially developed an AI-powered search and summarization tool, later evolving into an AI analyst. Matrix, Hebbia’s main product, can ingest multiple files of unlimited length and respond to user inquiries in a tabular format, similar to a spreadsheet. For instance, Matrix can sift through SEC filings and other documents to organize and compare information about a specific company and its competitors.

Hebbia primarily sells its software to asset managers, investment banks, and other financial institutions, but is expanding to other areas, including law firms and pharmaceutical companies. According to Sivulka, the company’s product is already used by 30% of all asset managers for due diligence, asset pricing, and other research. The fresh funding will be used to grow its team, continue selling to the financial services industry, and expand into other verticals.

Hebbia’s customer list includes investment bank Centerview Partners, Charlesbank, and legal firm Fenwick.

Sivulka, described as a wunderkind, worked at NASA as a teenager and graduated from Stanford with a bachelor’s degree in math in 2.5 years. He stands out among enterprise-focused founders for lacking direct business experience and not having a business-focused co-founder.

Related Posts:

- Hebbia Secures Nearly $100M Series B for AI Document…

- $130M Funding Boosts Sword Health's Valuation to $3B

- Series A Funding Secured: Vietnam's Prep Education…

- StepStone Raises Record-Breaking $3.3 Billion for…

- AI-Powered TechWolf Raises $43M for Internal Talent…

- Oyo’s Valuation Drops to $2.5B in New Funding Round