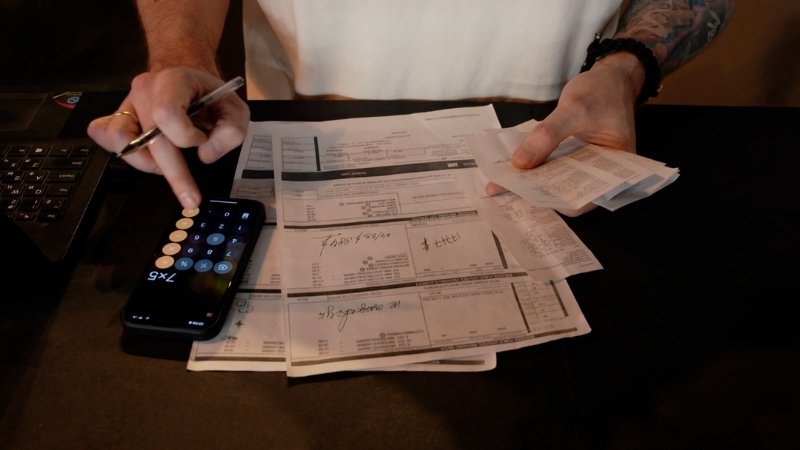

Cash is king — especially when you’re running a startup. The brutal truth?

Most startups fail because they run out of money, not because their ideas aren’t good enough.

If you don’t nail cash flow management in your first year, it doesn’t matter how brilliant your product is or how dedicated your team is — your business will collapse.

You need to keep cash flowing, spend smart, and be ruthless about cutting costs that don’t move the needle. It’s not about being cheap — it’s about being strategic.

From realistic financial projections to keeping your burn rate in check, we’ll break down the practical steps to make sure your startup survives that critical first year.

1. Set Financial Projections You Can Hit

Look, we all want our startup to be the next unicorn, raking in profits from day one. But here’s the hard truth: most products don’t take off immediately — and assuming they will is a recipe for disaster.

A classic rookie mistake is banking on sky-high revenue projections while seriously underestimating costs. It’s optimism dressed up as budgeting, and it’s a fast track to running out of cash.

How to Do It Right:

- Base Your Projections on Reality: Use conservative estimates instead of banking on best-case scenarios. Hope is not a strategy.

- Plan for Unforeseen Expenses: Legal fees, tech hiccups, unexpected marketing costs — factor them in from the start.

- Build an Emergency Buffer: Set aside at least 20-30% of your budget for unplanned hits.

Pro Tip:

Challenge every single assumption with data. Just because you think customers will flock to your platform doesn’t mean they actually will.

Validate those projections with market research and pilot testing.

If the numbers don’t add up, adjust your expectations before reality does it for you.

2. Make Cash Flow Your First Priority (Not Profitability)

Chasing profit in year one? Great ambition, terrible strategy. Startups that zero in on profitability too early usually end up with cash flow problems — and cash is what keeps the lights on.

Think of cash flow as your startup’s lifeline. Without it, profitability becomes meaningless because you’re already out of business.

Think About It Like This:

Would you rather have an impressive profit margin but zero cash on hand, or a modest margin with steady cash flow? The latter keeps your business alive. The former gets you nothing but a financial headache.

Smart Ways to Keep Cash Flow Positive:

- Shorten Payment Terms: Push for net-15 instead of net-30 with clients to get cash in faster.

- Leverage Subscription Models: Recurring income from subscriptions or retainer fees helps stabilize cash flow.

- Invoice Without Delay: Don’t sit on those invoices. Send them out immediately and follow up diligently. Unpaid invoices are like slow leaks in your financial boat.

- Use an online payment gateway: Streamline your invoicing process and get paid faster with a reliable, secure payment gateway. Automating payments reduces friction and helps keep cash moving.

Remember:

Cash flow isn’t just about making money — it’s about keeping it moving. Prioritize stability over profit margins in the early stages, and you’ll be better positioned to hit profitability when the business is on solid ground.

3. Spend Smart — Not Just Less

Let’s get one thing straight: being frugal doesn’t mean running your business on a shoestring budget and hoping for the best.

It’s about making every dollar work harder than your top salesperson.

Slashing costs randomly can hurt more than it helps — especially if you’re cutting corners on essentials like product quality or customer support.

How to Spend Smart:

Don’t throw money at flashy perks or expensive office spaces. Invest in areas that directly move the needle — like customer acquisition and product improvement.

Open-source software, trial versions, and community-driven platforms can cover your needs without breaking the bank.

Hire freelancers or contractors for non-core activities. Why pay a full-time salary when a short-term project can get the job done?

Pitfall to Avoid:

Don’t cut costs at the expense of customer experience. Saving a few bucks on support might seem smart until you start losing customers because they can’t get help when they need it. Spend wisely, not blindly.

4. Keep Your Burn Rate Under Control

Your burn rate is the pace at which your startup is spending money — and if it’s too high, your runway (how long you can operate before running out of cash) gets dangerously short. Monitoring this metric regularly isn’t just a good habit — it’s a survival skill.

Why Burn Rate Matters:

When your expenses are outpacing your revenue, it’s only a matter of time before the well runs dry. Ignoring your burn rate is like ignoring your car’s fuel gauge on a cross-country road trip — it’s not going to end well.

How to Keep Your Burn Rate in Check:

- Trim the Fat: Get rid of subscriptions, services, or software you don’t need. (Those monthly fees add up.)

- Track and Review Monthly: Calculate your burn rate consistently and set targets to reduce it wherever possible.

- Keep Payroll Lean: Hire only when necessary. Bring on part-timers or contractors instead of locking them into full-time salaries.

Quick Formula:

Burn Rate = (Starting Cash Balance – Ending Cash Balance) / Number of Months

Pro Tip:

Calculate your runway using your current burn rate to know exactly how many months you have left before hitting zero. Knowing this number keeps you sharp and focused on sustainability.

5. Bootstrap Like Your Life Depends on It (Because It Kind of Does)

Let’s be real — not every startup is VC-backed with millions to burn. Most have to get scrappy, and that’s not a bad thing. Bootstrapping teaches you discipline and forces you to make smarter financial choices. Plus, it keeps you in control, which means fewer cooks in the kitchen when making key decisions.

How to Bootstrap Like a Pro:

Instead of hiring a marketing agency, see if a friend with experience can lend a hand for a fraction of the cost.

Got skills? Barter them. Offer your expertise in exchange for someone else’s.

Embrace organic growth strategies — social media, content marketing, and community engagement. Paid ads are great, but they can drain cash fast if you’re not careful.

Sometimes, doing it yourself is necessary. Just make sure you’re not spending hours on tasks that could be outsourced cheaply and efficiently.

Bootstrap Mindset:

Think of every dollar as a tool, not a luxury. Invest where it counts, cut what doesn’t matter, and never spend just because it feels like the “startup” thing to do.

Final Words: Make Every Dollar Count

The brutal reality is that your startup’s survival hinges on how wisely you manage your cash. Don’t get caught up in dreams of profitability before ensuring steady cash flow. Keep a tight grip on your burn rate, and never assume that your product will be an instant hit.

Instead, build realistic financial projections and challenge every assumption. Make cash flow your number one priority — not just profit. Be strategic with your spending, and never mistake frugality for cutting corners where it truly matters, like customer experience or product quality.

Related Posts:

- What Is One Way to Begin Saving Startup Capital?…

- Top 5 AI Startups to Look Out For in 2024

- Indian Startups Set to Raise $8-12 Billion This Year

- How To Grow Your Startup Without External Capital -…

- How To Do SEO for Your Startup Website - Search…

- How to Validate Your Startup Idea - Idea Screening Explained