For startups, obtaining a business credit card can be crucial for managing expenses, improving cash flow, and building business credit.

However, startups often face challenges in securing credit cards without an established credit history.

That is why it is quite beneficial to look at business credit cards with no credit you should check out this year.

Table of Contents

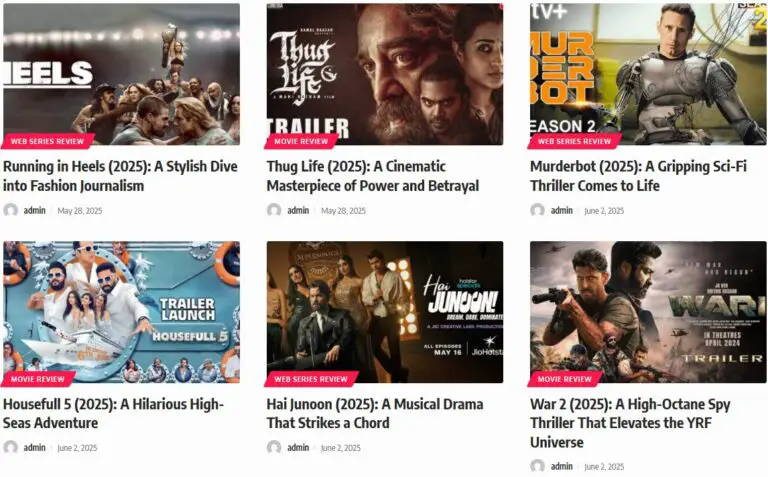

Toggle8. Ramp Corporate Card

The Ramp Corporate Card is a standout choice for startups because it eliminates the need for personal credit checks or founder guarantees.

It requires only an Employer Identification Number (EIN) and a minimum of $75,000 in a business bank account, making it accessible for startups with substantial initial funding.

Ramp offers a generous 1.5% cash back on all purchases, providing a straightforward and valuable rewards system.

This card is particularly beneficial for startups needing to maximize their cash flow without dealing with complex point systems.

Ramp includes:

- Comprehensive expense management software

- Simplifying tracking

- Controlling business expenses

The emphasis on transparency and ease of use, combined with the lack of personal liability for founders, makes the Ramp Corporate Card an excellent choice for well-funded startups looking to streamline their financial operations.

It supports a range of financial management tools that can integrate with existing accounting software, enhancing its utility for growing businesses.

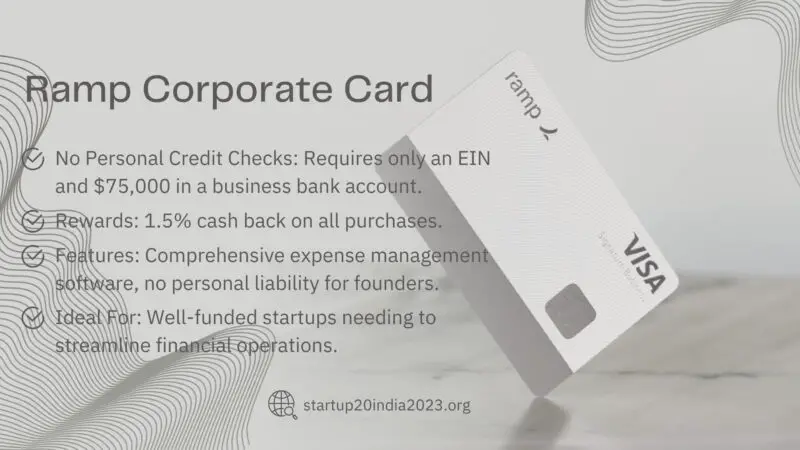

7. Brex Card

The Brex Card is tailored for venture-backed or mid-market companies, offering a unique approach to business credit.

It does not require a personal credit check or guarantee, focusing instead on the company’s financial health and backing.

It makes it an attractive option for startups with strong investor support but limited credit history.

Brex operates on a points-based rewards system, offering different points per purchase category.

Flexibility allows businesses to maximize rewards based on their specific spending patterns, such as higher points for travel or software purchases.

The Brex Card also comes with robust expense management features, making it easier for startups to manage and categorize their expenses.

The Brex Card offers a suite of Mastercard benefits, providing added value and security for businesses.

These benefits include travel insurance, purchase protection, and access to exclusive events and offers.

6. BILL Divvy Corporate Card

The BILL Divvy Corporate Card is an excellent choice for startups, as it requires only a soft credit check and an EIN for registered businesses.

The card offers a points-based rewards system and includes expense management software, providing comprehensive tools for financial oversight.

What sets the BILL Divvy Corporate Card apart is its emphasis on accessibility and simplicity.

The card’s rewards system allows businesses to earn points on everyday purchases, which can be redeemed for various benefits, contributing to cost savings and financial efficiency.

Divvy’s expense management features are particularly beneficial for startups, as they allow for real-time tracking and control of spending.

It can help startups maintain budget discipline and avoid overspending.

The ability to integrate with existing financial systems further enhances the card’s value, making it a versatile tool for managing business finances.

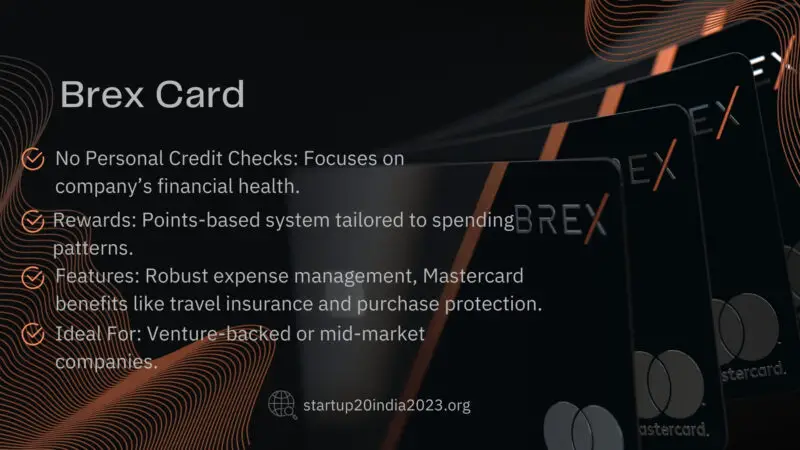

5. OpenSky Secured Visa Credit Card

The OpenSky Secured Visa Credit Card is a unique offering in this list, as it requires a refundable security deposit instead of a credit check or bank account to qualify.

This secured credit card is ideal for startups that need to establish or rebuild their business credit without the hurdles of traditional credit checks.

One of the key advantages of the OpenSky card is its accessibility.

Funding through online banking, money orders, or Western Union, provides flexible options for startups to secure their credit line.

The security deposit acts as collateral, which helps with:

- Mitigating the risk for the issuer

- Making approval more likely

OpenSky also offers the benefit of reporting to all three major credit bureaus, helping startups build their credit history over time.

It can be crucial for businesses that need to establish a solid credit profile to access more significant financing options in the future.

While it lacks some of the rewards and features of other cards, its focus on credit-building makes it a valuable tool for startups looking to strengthen their financial foundation.

4. Ink Business Unlimited® Credit Card

The Ink Business Unlimited® Credit Card is an excellent option for startups, offering straightforward rewards and no annual fee.

The card provides a flat 1.5% cash back on all purchases, making it an ideal choice for businesses with diverse spending needs.

The simplicity of the Ink Business Unlimited® Card’s rewards structure is one of its main strengths.

Startups can earn cash back on every purchase without worrying about rotating categories or spending caps.

Consistency can simplify financial planning and budgeting, allowing businesses to focus on growth rather than managing complex rewards programs.

The lack of an annual fee makes this card a cost-effective option for startups looking to maximize their financial resources.

It provides access to valuable benefits such as purchase protection, extended warranty coverage, and travel insurance, adding further value to its offerings.

The Ink Business Unlimited® Credit Card combines simplicity, value, and essential benefits, making it a strong contender for startups seeking a reliable and rewarding business credit card.

3. Capital One Spark Miles for Business

The Capital One Spark Miles for Business card offers significant rewards for startups, with a $0 introductory annual fee for the first year and $95 thereafter.

It provides 2x miles on every purchase and 5x miles on hotels and car rentals booked through Capital One Travel, making it an attractive option for businesses with travel needs.

One of the key benefits of the Spark Miles card is its flexible rewards program.

Miles can be redeemed with no minimum redemption amount, allowing startups to use their rewards as needed without waiting to accumulate a large balance.

The Spark Miles card offers a range of travel and purchase protections, including:

- Travel accident insurance

- Rental car insurance

- Extended warranty coverage

These benefits add significant value, especially for startups with frequent travel requirements.

The combination of high rewards potential, flexible redemption options, and robust benefits makes the Capital One Spark Miles for Business card a powerful tool for startups aiming to maximize their travel and everyday spending.

2. The American Express Blue Business Cash™ Card

The American Express Blue Business Cash™ Card is an ideal option for startups with annual spending below $50,000.

This card offers no annual fee and provides 2% cash back on up to $50,000 in purchases per year, then 1% thereafter.

One of the standout features of the Blue Business Cash™ Card is its expanded buying power.

American Express offers flexibility for businesses to spend beyond their credit limit, adjusting based on their payment history, credit record, and financial resources.

It is particularly beneficial for startups that need occasional increases in spending power without the hassle of formally requesting a higher credit limit.

The card also includes access to valuable tools and benefits, such as:

- Expense management features

- Purchase protection

- Extended warranties

These benefits enhance its value proposition, making it a comprehensive financial tool for startups.

The American Express Blue Business Cash™ Card offers a compelling combination of cash-back rewards, spending flexibility, and essential business benefits, making it a top choice for startups with moderate annual expenses.

1. Bank of America® Business Advantage Travel Rewards World Mastercard®

The Bank of America® Business Advantage Travel Rewards World Mastercard® is designed for startups seeking to maximize travel rewards without incurring annual fees.

This card offers 1.5x points on every purchase, with higher points available through the Preferred Rewards program, making it an attractive option for businesses with diverse spending habits.

A significant advantage is the absence of international transaction fees, which can save startups money on overseas purchases.

The flexible redemption options for travel and statement credits provide additional versatility in using earned rewards.

Moreover, the card offers various travel-related benefits, such as travel accident insurance and rental car insurance, adding further value for startups with travel needs.

The combination of no annual fee, robust rewards program, and comprehensive benefits make the Bank of America® Business Advantage Travel Rewards World Mastercard® a strong choice for startups looking to optimize their travel and everyday business spending.