Emerging economies frequently grapple with trade deficits, driving up demand for the dollar, which dominates global trade, while supply remains limited. This imbalance inflates costs and delays transactions. In Africa, the challenge is further intensified by the scarcity of tech solutions addressing the liquidity needs of large enterprises and multinationals, as many cross-border payment platforms focus on consumer-facing products.

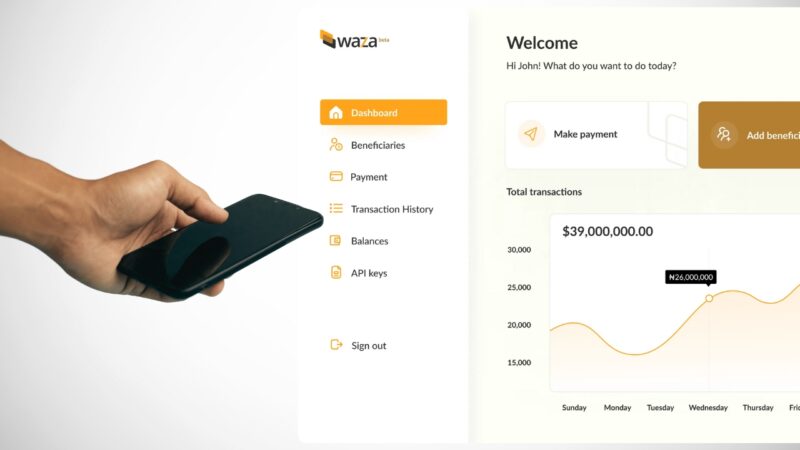

Waza, a Y Combinator-backed payment and liquidity platform, is addressing this gap, emerging from stealth with $8 million in seed funding. The startup aims to simplify global supplier payments for African businesses and traders, tapping into a $7 trillion market with the potential to generate $250 billion in revenue.

As reported by TechCrunch, cross-border fintech and payments is a burgeoning segment, particularly among recent Y Combinator-backed startups. The market, projected to exceed $250 billion by 2027, sees fintechs increasingly challenging traditional banks, especially in the B2B sector.

Waza, which began operations in January 2023 following its participation in Y Combinator’s winter batch, is poised to capitalize on this trend and establish its presence in the global payments market, starting in Africa.

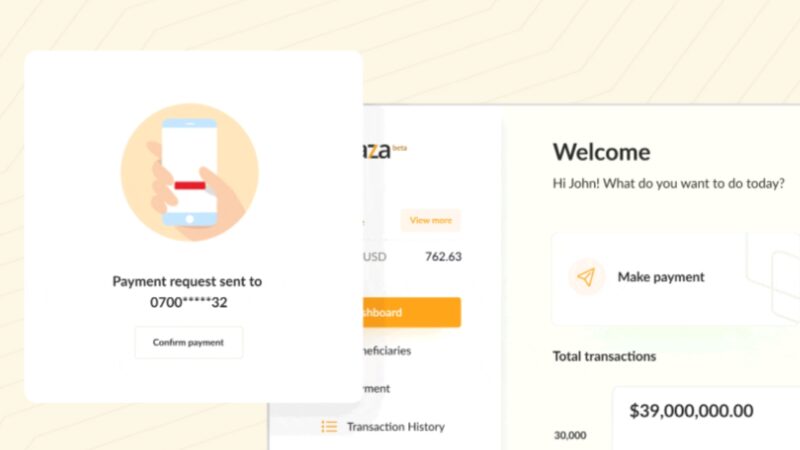

In its first month, Waza’s total payment volume was $280,000, according to co-founder and CEO Maxwell Obi. By May, the fintech was processing up to $70 million in monthly payment volume, translating to an annualized transaction volume of $700 million. Obi also noted that Waza’s transaction volumes and revenues, derived from FX spread and a 0.75% to 1% take rate, are growing by an average of 20% monthly.

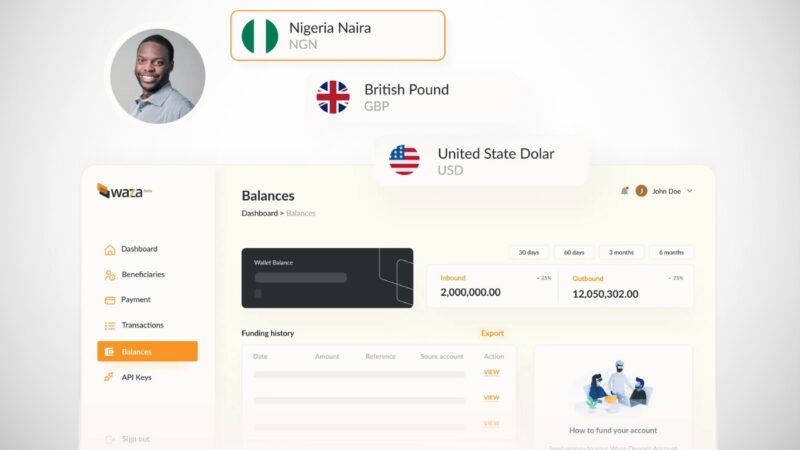

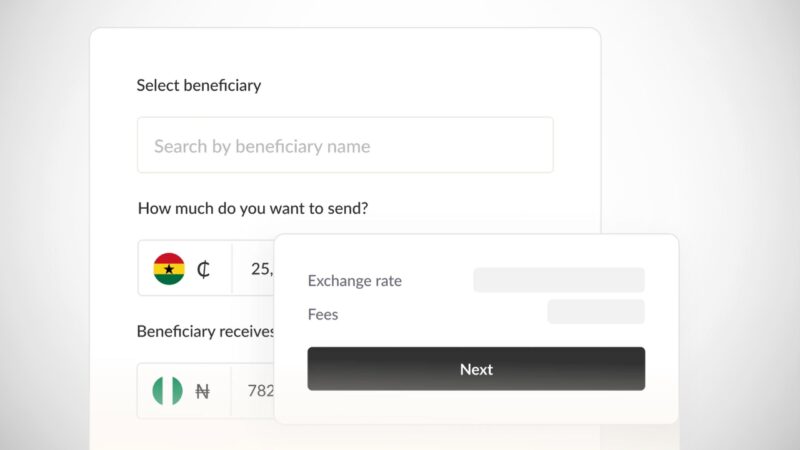

The startup facilitates business payments and liquidity management across six continents for hundreds of clients, categorized into three groups with varying needs: multinational organizations like U.S.-headquartered airlines operating locally in Africa, importers and traders transacting with suppliers from countries like India, China, and the U.K., and other fintechs and developers requiring API infrastructure for cross-border payment solutions. Competitors in this space include AZA Finance, Verto, and Conduit, which recently expanded into Africa from Latin America.

“Cross-border payments in trade mean businesses need to pay suppliers quickly and expect prompt delivery, with exchange rates impacting profitability. Our value proposition is affordability and speed of settlement,” said Obi. He emphasized Waza’s global banking relationships and partnerships as a competitive advantage, allowing the platform to offer more control over payment infrastructure and position itself as a cheaper market option.

Before founding Waza, Obi co-founded Amplify, a Nigerian fintech acquired by Carbon, and later worked at Zepz subsidiary Sendwave. His experience with Sendwave, particularly in navigating partnerships and regulatory relationships across Africa, Asia, and Latin America, inspired the creation of Waza after recognizing the need for a global supplier and vendor payment service.

Obi co-founded Waza with CTO Emmanuel Igbodudu, a senior engineer from Revolut with a background in prominent Nigerian fintechs like Moniepoint and Fairmoney. Their technical expertise is expected to be instrumental as Waza expands into trade finance and cross-border payment solutions, with plans to develop products that cater to B2B payments.

Although specific details remain under wraps, Obi hinted at the possibility of Waza developing a banking product for businesses, akin to Brex or Mercury for Africa, potentially including credit or financing, or a stablecoin banking product for the digital economy.

The seed investment will fuel these initiatives and support expansion into new markets beyond Ghana and Nigeria. The round includes $3 million in equity from Y Combinator, Byld Ventures, Norrsken Africa, Heirloom VC, Plug and Play Tech Center, and Olive Tree Capital. Additionally, Lagos- and New York-based Timon Capital provided $5 million in venture debt financing, which Waza plans to use to pilot trade financing for large enterprise clients.

“The Waza team has deep expertise in cross-border flows and is targeting one of the largest opportunities in frontier markets,” said Chris Muscarella, managing director of Timon Capital, on the investment.