Investors are increasingly focusing on Indian wealthtech startups as the country’s growing middle class seeks to diversify investments and startups compete with traditional financial advisors for high-net-worth clients.

Premji Invest is reportedly in advanced discussions to lead a funding round of $30 million to $40 million for Dezerv, an app offering investment solutions to India’s wealthy. The current talks value Dezerv at about $170 million pre-money, more than doubling its valuation since its last funding round.

Lightspeed Venture is also in advanced talks to lead an investment round exceeding $20 million in Centricity, a digital wealth management platform. In October, Peak XV agreed to invest approximately $35 million in the wealth and asset management startup Neo.

The high-net-worth and ultra-high-net-worth segments are booming in India, prompting wealth management firms to expand their relationship manager networks aggressively. Currently, only about 50-55% of India’s wealth management market is under professional management, according to analysts.

A significant portion of these services remains relationship-driven and demands a bespoke approach. Investors believe that startups can eliminate intermediaries, provide more personalized and data-driven recommendations, and serve a market segment currently neglected by incumbents.

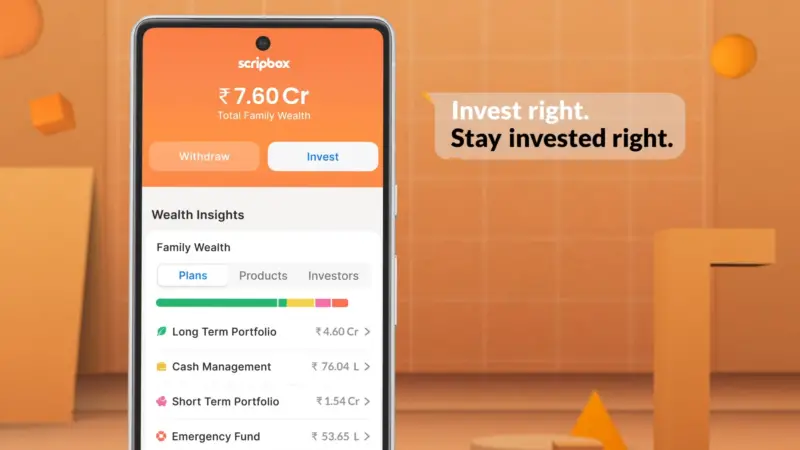

Accel-backed Scripbox has experienced a turnaround in its business over the past two years, becoming profitable and managing assets of over $2 billion, according to its founder and CEO Atul Shinghal.

India is also witnessing a surge in the financialization of its economy, with significant growth in sectors like insurance and mutual funds. The number of mutual fund accounts has increased 3.5 times since 2015, with substantial gains in low-ticket-size systematic accounts over the past three years.

Despite this growth, there is still significant room for expansion. India’s ratio of mutual fund AUM-to-GDP is 15%, compared to a global average of 75%. Analysts believe that as penetration improves, the mutual fund industry can continue to grow at 20% annually. UBS estimates a 22-25% CAGR in active AUM over FY24-27E for leading wealth management players.

Several startups are also helping more Indians invest in mutual funds, stocks, and gold. Jar, backed by Tiger Global, encourages customers to build a habit of savings, targeting the $100 billion Indian gold market. The startup’s average customer makes 22 investments each month, according to co-founder Nishchay AG.

India’s affluent population is set for significant growth. The number of individuals with annual incomes exceeding $10,000 is expected to more than double in the next five years, providing strong growth opportunities for financial services platforms targeting this demographic.

Average monthly retail inflows via systematic investment plans have grown to record highs at a CAGR of around 20% over the last eight years, according to Goldman Sachs.

360 One WAM, India’s largest wealth manager for ultra-high-net-worth individuals, recently acquired the mutual fund investment app ET Money for about $44 million.

CRED acquired the mutual fund investment platform Kuvera earlier this year. Smallcase, a startup that CRED considered for acquisition but ultimately passed on, is in talks to raise $40 million at a valuation of around $240 million.

Eight Roads, a venture firm affiliated with Fidelity, is evaluating an investment in Asset Plus, another mutual fund platform.

More competition is on the horizon. Reliance, India’s most valuable firm, partnered with BlackRock, the world’s largest asset manager, last year to form a joint asset management venture in India. Both companies are targeting an initial investment of $150 million each into the new 50/50 venture, which aims to offer tech-enabled access to “affordable, innovative” investment solutions for millions of Indian investors.

In April, they announced another joint venture focused on wealth management and broking business in India.

Related Posts:

- Why Software Engineer Salaries in India Are Rising in 2024

- Shiv Nadar Net Worth - Latest 2024 Updates on India…

- Top 10 Fastest-Growing Industries in India to Invest…

- India’s Top Apps in 2025 - The Digital Tools You…

- Indian Startups Set to Raise $8-12 Billion This Year

- Top 10 Low-cost Marketing Strategies for Startups